Building a Real-Time Stock Price Predictor

₹10,000.00

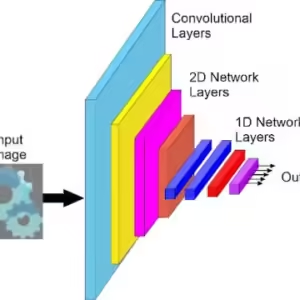

Developing a real-time stock price predictor entails using machine learning algorithms and financial data to estimate stock values as soon as possible. Gathering current stock market information, such as past prices, trade volumes, and pertinent financial indicators, is the first step in the procedure. To manage missing values, normalise data, and eliminate noise, data preparation is crucial. To identify temporal trends in the data, time-series forecasting models like recurrent neural networks (RNNs), ARIMA, and Long Short-Term Memory (LSTM) networks are commonly employed.

To understand the underlying trends and price movements, these models are trained using historical stock data. The system is connected with live data flows to guarantee real-time prediction, allowing it to update forecasts continually as new data becomes available. Metrics such as Mean Absolute Error (MAE) and Root Mean Square Error (RMSE) are used to assess the performance of the model. Traders and investors benefit greatly from accurate stock price forecasters, which enable them to make well-informed choices in the volatile financial markets.

Reviews

There are no reviews yet.